In an increasingly cashless culture, many parents like me are looking for new ways to teach their kids the importance of money and finance. Helping them understand where the money comes from, how they can earn, save and spend money and setting them on the path to financial independence.

Frustratingly the major banks only offer basic saving accounts for kids under 11 years old, with no debit card. The alternatives like Go Henry and Natwest Rooster have seen an opportunity and challenged that but come with fees that leave you questioning – is it worth it?

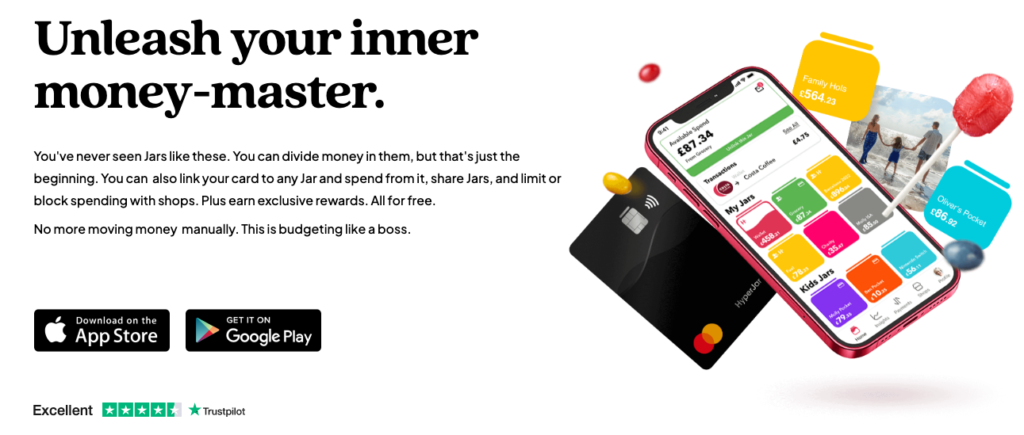

Enter HyperJar!

This relatively new entrant in the finance scene could be the answer to teaching kids learning about money and offer a few perks for the whole family along the way.

In this review, I want to share my personal experience as a parent of getting a HyperJar Kids Card for our children and how it helps them to learn about money in a cashless world.

What is HyperJar?

HyperJar is a money management app that helps you and your kids save, budget, and spend. Currently, the only fee-free card option for kids under 11 also provides excellent travel and shopping perks.

The clever people behind HyperJar have looked at the market and seen opportunities to provide services where everyone else wants to charge you fees.

First, HyperJar is not a bank; it’s more of a money management app using the jam jar (piggy bank) concept to budget, save and spend money. With great features for adults, but for me, even better for your kids, the main reason we applied for it.

Cutting to the chase, my favorite things about HyperJar.

Best HyperJar Features For kids:

- Zero fees

- Their first contactless Mastercard for kids aged 6+

- It can be added to Apple or Google Pay for children aged 13+.

- An easy way for you to give them pocket money each week in this ever-cashless world.

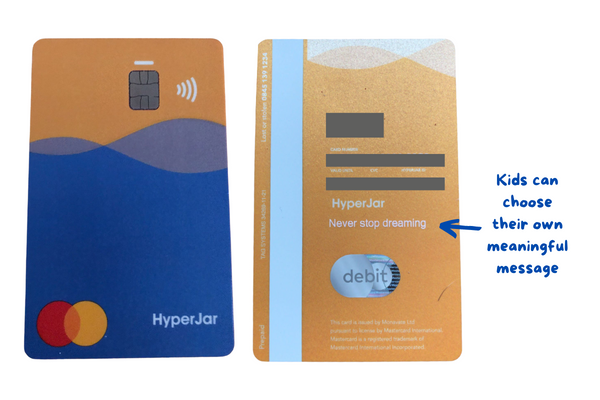

- Personalized Mastercard with a meaningful message they choose.

- A kids’ app for them to set up jars and manage their money.

- Full parental control and notifications.

For adults:

- Zero fees

- Mastercard works in 36 million locations across 200 countries.

- It can be an actual card or added to Apple or Google Pay.

- No more currency charges when you spend money abroad.

- It automatically gives you the best exchange rate.

- Discounts and special offers from main brands and stores.

- AGR (Annual Growth Rate) or committed growth on your money (more on this later).

- A simple budgeting tool to help you manage your money.

How Does HyperJar Works?

HyperJar is not a bank account, so you will not earn interest on the money you keep in your jars. You need a bank account somewhere else to add money into your jars. Your HyperJar will, however, have a sort code and account number just like your regular bank account. This means that you transfer money just like any other bank account.

Think of it as a pre-paid debit card, where you can divide your money into jars and then set up controls for those jars to manage your spending, such as set spending limits.

We were looking for a payment card for our 7-year-old daughter when her friend’s mum took them swimming and for dinner every week at a local gym, which doesn’t take cash.

HyperJar card was the perfect answer. Our daughter uses her HyperJar card to pay for her meal. By having the ‘Gym’ jar, we can add money to that jar and link it to the gym, so when she pays, the money can only come from that jar and not her pocket money jar.

You can even link your jars as a backup if you forget to put money in. This feature is called ‘Only List.’ She can ‘Only’ spend in that location.

How to Add Money to HyperJar?

In my experience, the easiest way is to link your current bank account to HyperJar.

Open the app, tap on your HyperJar Wallet, tap ‘add,’ and choose ‘Bank Account .’Select your bank. Enter the amount. Agree and continue. The app then takes you directly to your bank account app, using your normal security checks, to confirm the amount.

Or, if you select the profile page in the app, you will find your sort code and account number. You can use these to add funds using the same process as making a payment from your bank.

To add money to your kid’s HyperJars, you need to have money in one or more of your HyperJars. Select your kid’s jar, click ‘add,’ and choose where the money is coming from, like ‘Wallet .’ Enter the amount, and tap ‘Next’. Tap ‘Confirm.’

How to Transfer Money to Your Kid’s HyperJar?

A great feature of HperJar is you can share jars with friends and family to make it easy to send, save and pay.

Others can transfer money to your children’s HyperJar in two ways:

- They can download and sign up for the HyperJar app. Then link the kid’s jar directly. The shared jars appear on each person’s home screen. This works great for family or friends who makes frequent money transfer to your children.

- For those one-off transfers, others can simply transfer the money to the parent’s account. Then you, as the parent, can transfer to your kid’s HyperJar.

How Can HyperJar Help You Budgeting?

You can use the same method to set up your jars (budgets) to track and manage how you spend money – maybe meals, coffee, groceries, transport, take-outs, fuel, or transport. All can be linked to the stores you use. It does make budgeting and spending totally in control.

You can take linking to stores even further. This is called AGR committed growth. You commit to spending money with a certain retailer, and in return, they give you ‘committed growth – interest.’ Typically this is 4.8% annual growth but can go up to 10%, higher interest than any current bank account.

For example, if you know you will spend with TUI every year for a holiday, you can create a holiday jar, link it to TUI, and commit £1000. The following year, when you pay for the holiday will get £1048 to spend. This money is known as HMoney.

Any money you have in HyperJar is protected by the FCA (Financial Conduct Authority).

In addition, you can share your jars with friends and family – making it easy to pay for group outings or holidays, meaning no one has to pay upfront; you can all budget and save together.

Can HyperJar Be Used Abroad?

HyperJar is a pre-paid Mastercard that gives you the best exchange rate and does not charge you any additional fees.

Cards like this are getting harder and harder to find, so this is a great feature—fee-free payments in over 200 countries and 36 million locations. Just be sure to toggle the ‘Spend Abroad’ switch to enable use when you are out of the country.

Is HyperJar Fee Free?

Yes.

In comparison to the best competitors,

- Go Henry is £2.99 per month per child, £35.88 a year.

- Natwest Rooster is £1.99 per month, £19.99 a year.

- Nimble is £1.99 per month, £22.40 a year.

These all tend to offer 1 to 6 months free when you sign up, and they do have the bonus feature of working in ATMs. For me, that was not a deal breaker for HyperJar, as my kids rarely need actual cash these days.

They also charge if you perform more than one transfer of funds daily, which can be steep at £0.50p a transfer. HyperJar allows 3 in and three out every day.

The watch-outs for HyperJar are, a replacement card costs £5, and if you want to get money back from HyperJar, they will charge you £25, so only transfer what you know you want in your jars.

The main banks offer savings accounts for kids, often free if you bank with them, offering good interest rates of 3% on savings up to £3000, but until your kids are 11, it’s just a savings account – not visible to them and not interactive.

These bank accounts still should be your main savings account for your kids, but HyperJar compliments these perfect for kids’ pocket money, holiday money, saving for something special – and having a contactless card!

How to Sign Up to HyperJar?

Signing up is quick and easy. Firstly, you need to download the app. Then add some basic information and record a guided verification video. You only have to turn your head and read out some numbers – don’t worry, it’s not an audition.

Account approval then follows in a matter of minutes.

You can then link to your bank account, create some jars, add some money, and you are good to go. A virtual card can instantly be added to your Apple Wallet or Google Pay. You can also request an actual card if you want.

At this point, you can also request accounts and cards for your kids.

Even this process can be interactive and fun for them.

I ordered the HyperJar kid’s card with my daughters (7 and 9) together, selecting the meaningful phrase that comes printed on their card and choosing either one of the HyperJar monster characters or a picture from my phone as an avatar to use on the kid’s app.

It said the cards would arrive in 7-10 working days, but they came in less than 5. When they arrived, activation was easy using the app, just entering the last four digits of the card number.

The Kid’s App

If your child has a mobile phone, they can download the kid’s version of the app. If not, they can just share it with you.

The kid’s app must be linked to an adult account, so you must keep yours active.

The app allows kids to set up jars to focus on what they want to achieve, save pocket money, save for a new game or toy, or even donate to charity. Each jar can be named and have its own color.

Parents, guardians, or carers can set up direct payments from your jars or bank account for weekly pocket money, chores or rewards. The same goes for the wider family and friends, so sending birthday money is super easy.

At 13, the card can also be added to their Apple Wallet or Google Pay.

Parents and kids instantly get spend notifications, and you still have full control to set spending caps and even select which stores can be used with which jar.

Be warned; my kids constantly want to know how they can make pocket money. Now, they can see it going in their HyperJars.

Is Your Money Protected?

HyperJar is not a bank and, therefore, not covered by the Financial Services Compensation Scheme (FSCS).

It is covered by the Financial Conduct Authority (FCA), and your e-money is stored in the Bank of England, so if anything were to happen to HyperJar, you would get your money back.

How Easy Is The App To Use?

The app is very easy to use, and even if you get stuck, there are lots of ‘how to videos on the HyperJar website.

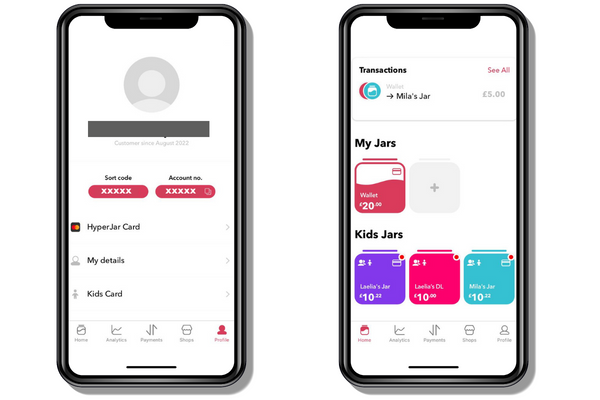

When you open the app, you instantly see your available spend, ‘My Jars,’ Kids Jars,’ and contacts such as family and friends using HyperJar.

At the bottom of the screen is:

- Analytics – helps you track your spending habits and the categories you spend in.

- Payments – allows you to pay contacts and add money to HyperJar.

- Adding money is super easy if you link your bank account. Select your bank from the list, enter the amount you want to transfer, and the app then takes you straight to your bank app, with all the transfer details pre-populated for you to check and hit transfer. All require a touch ID or login. It can’t just access your account.

- Shops – is the section where you can see offers and rewards, either as an A-Z list of shops or just the ones with active offers.

- Profile – is where you find your account number and options to see card details, freeze cards, spend abroad, order a physical card or add the virtual card to Apple Wallet or Google Pay. You also order your kid’s cards and link your bank account from this section.

HyperJar for the Adults – Travel, AGR, Budgeting, Stores

The main attraction of HyperJar is the free kid’s Mastercards, but here are my top features that might just be of interest to the adults.

- Fee FREE when using abroad.

- Local country rewards while you are abroad.

- It guaranteed best exchange rate.

- Cashback and matched spend offers.

- HMoney – AGR committed growth on the money you commit to spending with specified stores. Please note you have to spend the committed store. You can’t change your mind about stores later.

Pros & Cons

The pros easily outweigh the cons when I compare HyperJar to other options for kid’s bank accounts.

Pros

- Free app and card

- Teaches essential financial skills

- Available from 6-17

- Zero fees

- Paired to an adult account

- Set up as many jars as you want

- Kids get to choose the color and name of jars

- Easy payments

- Kid’s version of the app if they have a phone

- 13+ can use Apple Wallet and Google Pay

Cons

- No ATM use

- One parent control

- £5 for a replacement card

- £25 to recall money

Final Thought on HyperJar Review – Best Free Bank Card For Kids

If you are looking for a fee-free bank card for your kids to learn how to save, budget, and earn money in this cashless society, I highly recommend Hyperjar.

As a parent, I love that it’s super easy to use and has complete control.

My kids love having personalized HyperJar bank cards of their own. It’s a fun and interactive tool to help them learn about money management and visualize their earnings and spending.

HyperJar FAQ:

How To Top Up HyperJar?

You add money from your current bank account. HyperJar makes this super easy by linking directly with your bank.

How To Create Jars for Kids?

First, you need to set up your account on the app, create the jars and then share them with your kids, setting the appropriate permissions.

What Is HyperJar kids?

The same app but with less functionality that can download on their phones. It’s connected to your HyperJar, and you can still set controls and permissions. It provides a great step in their financial independence. You also get all spend notifications instantly and can suspend the card if needed.

How Do Travel Charges like TFL and Buses Work on HyperJar Card?

When you use HyperJar on TFL or buses, you can see a 10p charge, called an authorization charge. This check the card is valid. The 10p charge is then taken off when the full cost of travel is charged. It can take up to 24hrs for this to happen.

How Can I Freeze My HyperJar Card?

Select ‘Profile’ on the app’s Home Page, then select ‘HyperJar card,’ toggle the ‘Freeze Card’ switch to “ON.”

How Do I Download the HyperJar Kid’s App?

There is only one app, so you download the same app from the App Store or Google Play. You will be asked to link it to the parent’s app during the sign-up process, limiting the features.

Can I Use My HyperJar Card Abroad?

Yes. Select ‘Profile’ on the app’s Home Page, then select ‘HyperJar card,’ and toggle the ‘Spend Abroad’ switch.

Where Can I Not Use the HyperJar Card?

HyperJar and Mastercard do not provide services to businesses or support transactions that involve gambling/betting; currency conversion services; traveler’s cheques; adult content; toll and bridge fees; rental car companies; pay at pump terminals in petrol stations (but you can pay at the counter), or the purchase of cryptocurrencies.

What Are The Account Limits for HyperJar?

Accounts have a max limit of £10,000. Three transitions in and out per day are allowed, with a

max daily load of £5000.

HyperJar Review – Best Free Bank Card For Kids [Pin it for later…]

![Read more about the article 37 Things to Buy From Aldi UK to Save on Food Bill [and Better than Big Brands]](https://itsnotyour9to5.com/wp-content/uploads/2020/05/Things-to-buy-from-Aldi-FB-300x157.png)

Hello Chloe,

What a great website. I love the idea of teaching children about money and the way to use it and save it. And giving them the ability to pay for things when they are on their own without needing cash on hand all of the time. I wish they had this when my children were younger.

Have a wonderful day!

The world is so different now that when we were younger. Teaching children about money in this cashless world presents challenges. I am pleased to find HyperJar as a way of teaching them about money and helping them to visualize it without having to hand the cash.

Hi Chloe,

Thank you for this post with HyperJar review- which offers financial education and teaches money management in the early stages of life with parental control.

I appreciate all the features that benefit kids. You have explained this card’s features thoroughly.

It looks simple but truly sophisticated for kids to manage their finances.

The adult features are helpful. I always struggle when I visit India from the USA. Running to the bank and getting cash to pay in places can be replaced with a HyperJar card. They give you interest for deposits for travel money, offer you the best conversion rates, and can even be better than the CITIcard I have currently.

It seems easy to set up. I can connect this to a bank account and set the money transfer to the card. Do I need to have an apple or Google pay set up for international travel?

Thank you very much for this post.

Wow. This is a great idea. A bank card that teaches our little kids to save, budget, and earns money. I like the fact that it’s so easy to use and gives you full control of their spending habits. But I’m sure it’s available in specific countries as there have been no adverts or anything related lately. But all-in-all thanks for the review.

HyperJar is only available in the UK but hopefully, it will soon expand to more countries.