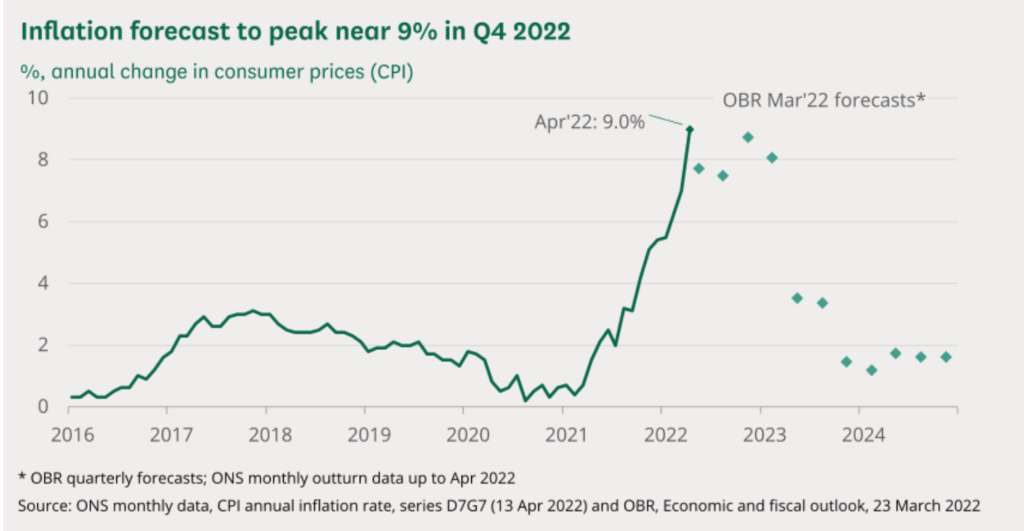

The cost of living in the UK has been on a steep incline since early 2021. In April 2022, the CPI (Consumer Prices Index) Inflation rate was measured 9.0% higher than a year before. This is the highest in decades. [Source].

Whilst the cost of living is on a steep incline in the UK, our earnings don’t seem to be keeping up the pace, which leaves many of us struggling more than ever before to make ends meet each month.

Brexit and COVID-19 are just a couple of factors that have made the future of our finances uncertain.

It’s hard to know exactly what will happen in the next few months, or even years, but one thing is for sure – we need to be proactive about our money.

I’ve put together a list of 25+ clever money saving tips for UK living by category. By making these small changes, you can easily save over £3,500 a year. So you can breathe a little easier – even in these uncertain times.

This post may contain affiliate links, meaning I may earn a small commission at no cost to you if you make a purchase. Please read the disclosure for more information.

FINANCES

The first a few tips are to help you straighten out your finances.

Some of these may not feel like short-term savings but making these small changes to your credit cards, current account, or savings accounts could mean big savings for you and your family’s future long term.

1. Paying Off Credit Card Debts

If you have credit card debt, paying off these debts as soon as possible will save you from paying hefty interest rates.

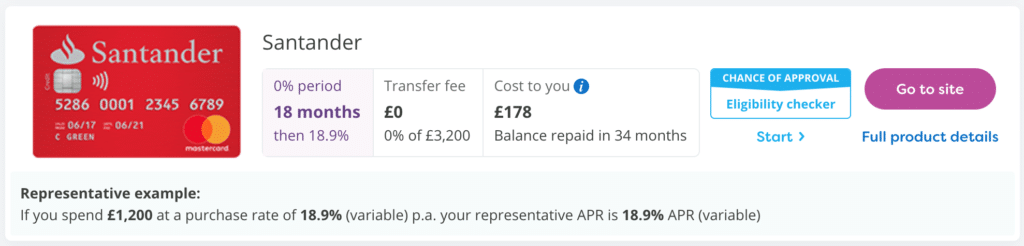

Firstly, move the credit card debt to a card that has a 0% balance transfer, this is really important as many credit cards have a pretty hefty transfer fee of around 3-4% of the transferred balance.

Secondly and even more importantly look for 0% interest for a period. This will give you a time frame to pay off the debt, normally around 12 to 18 months.

Here’s an example from MoneySupermarket of the type of credit card you should be looking for:

Be sure to know when that interest-free period runs out as it will jump to a hefty rate afterward.

Don’t be worried about this if you haven’t managed to fully pay off the credit card debt.

Just give yourself enough time to apply for the next credit card. You will be able to find the best deal on price comparison websites.

Finally, to pay off the debts, use Dave Ramsey’s Debt Snowball strategy to start from the smallest to the largest.

For a short version, check out the web story:

2. Stop Borrowing and Start Budgeting

This is a mindset shift more than anything – only spend the money you have!

Starting to make a monthly budget while you are paying off debt is an important part of the mindset shift.

It will help your financial situation, show where there may be room for improvement in understanding where your money goes, and give more control over your spending habits!

Use this FREE budgeting app, to get all your money under the control, but if you prefer pen and paper, you might prefer this simple FREE Budget Planner Printable ?.

3. Maximise Pension Contributions

It’s never too early to save for your retirement.

Aim to contribute 15-20% of your monthly income to a pension, which can be in the form of a private pension, a company pension, or an investment ISA.

For those of you who are in a company pension scheme, many employers match or add to your contributions. So max it out in order to take advantage of the employer’s contribution.

You can also use your pension to reduce your tax bill and let’s face it you need to find all the tax reliefs you can.

If you are lucky enough to get a bonus through work, check out how you can use some or all of it to top up your pension fund, this way you avoid paying tax on the bonus.

You won’t get any benefit right now. This is an investment for the future, but it’s better coming to you eventually rather than paying it in tax right now.

That’s FREE money towards your retirement!

4. Payoff Mortgage Earlier

Another long-term smart household money-saving tip is to pay off your mortgage earlier by over-paying.

The most common mortgages in the UK are called repayment, where you pay off a bit of the loan and pay interest as well.

The other type is interest only. This is less common as you only pay interest during the term of the mortgage each month, and then have to find the loan amount to pay off at the end.

For our repayment mortgage, overpaying by £350 a month means we are saving £11,000 over the term of the mortgage and become debt-free 5 years earlier.

You can also pay a lump sum as an overpayment if that works for you.

Most online mortgage accounts provide a simple calculation to help you work out how much you can overpay each year. Find out how much you can save from yours.

This small step will save big for you and your family long term, as you are generally paying double the amount you borrowed back.

5. Switching Your Bank Account

Some banks have incentives for you to switch your current account and sometimes as a bundle with your savings account.

As many of the terms and benefits of today’s bank accounts are similar – this is basically free cash.

You can easily find deals that give you between £50 and £150. Again you can use price comparison websites to get the best deals.

A free overdraft is less common these days, but if you can find a deal, and that’s something that gives you that bit of comfort towards the end of the month that could help you narrow down which bank to move to.

FOOD

Food is an area that makes up a large portion of the monthly bill, especially if you have a large family.

But the good news is, there is plenty of room to save here.

The next few household tips on FOOD alone will help you save over £1,500 a year.

6. Eat Out Less

Do you know an average UK household spends £1,581 a year on eating out? (Source: National Statistics).

The bigger the family, the more costly it is to eat out.

Don’t get me wrong, I LOVE dining out not just for the food, but also just being served and not having to worry about clearing up afterwards.

Try to reduce the number of times your family eats out per month, you will be amazed at how much you can save. Plus, if you use the following tips when you do eat out, you will save even more.

7. Early Bird & Happy Hour Deals

When you do treat your family for a meal out, consider having an earlier meal. Many restaurants do early bird or happy hour deals before 7 pm.

This is great for families with children and friendly for your wallet.

8. Swap Dinner for Lunch

Another alternative way to save is to eat out for lunch instead of dinner.

Many restaurants set a higher price on their diner menu than lunch menu, even for the same dishes!

So going out for a family lunch is a great way to save especially if you want to try some fancier restaurants.

9. Meal Plan for Food Shopping

When it comes to food shopping, having a weekly meal plan is the key to saving big.

This will not only reduce the number of trips to the shops per week, saving money on fuel or transport, overspending as you always buy some special offer every time you go, but it can also reduce the waste food that you throw out every week.

Plan out the meals that your family is going to have, including drinks and snacks etc.

Then transfer the ingredients to a shopping list. This way, every item you purchase has a purpose allocated during the week. This is how you avoid multiple trips to the store, special buys, and waste.

To help you out a little, you can subscribe and get my FREE meal plan here:

10. Shop at Aldi

I’ve been shopping at Aldi on a weekly basis for the past 5 years. Despite having to get used to a slightly different way of how they operate (like having to bring your £1 for the shopping trolley), they have won me over on the quality and price consistently.

We spend on average £80/week shopping in Aldi for a family of 4, which is over £30 lower than an average household spends on food shopping. That translates to a £1,560 saving each year, which is always good to see in your bank account.

11. Eat Less Red Meat

Eating less red meat on a regular basis, not only it is wallet-freindly, but it’s healthier for the family.

Cutting meat out 1-2 times a week, can save you as much as £300 a year!

Got little fussy eaters at home, or a meat-loving partner?

I got you here.

Here are 3 tried and loved vegetarian recipes from my household:

- Slimming World Slow-cooked Mac & Cheese

- Turmeric Cauliflower Soup

- Slow-cooked Chocolate Vegetarian Chilli

HOUSEHOLD BILLS & PURCHASES

This category of household tips is for anything you buy and use on a regular basis.

Because of the frequency of buying and using these items, small savings of a few pounds can add up quickly.

Applying the following tips, you can potentially save over £1,500 a year.

12. Kick-Backs from Credit Card

Are you taking full advantage of having a credit card, especially when shopping online?

Many credit cards have kick-backs either as cash, points or vouchers.

Choose the perks that are of high value to you and you know that you will get the benefit.

As an example, my mother-in-law collected air miles from her credit card for years, which only amounted to a flight within Europe for one person, which was hard to book so she never used them.

Learning from her lesson, we instead, get the M&S vouchers from our HSCB credit card based on our spending. We then often use the vouchers on school uniform or wines especially when M&S run their 25% off six bottles offer.

13. Use Cash Back Sites

Using cashback sites on your regular purchases is another great frugal tip. We save on average £200 a year through these sites on things from holiday deals to gifts.

A few of my favourite cashback sites are TopCashBack, Quidco (get a £1 using my link), and Ohmydosh. While they are FREE to join, together they cover thousands of retailers.

Sign up for 2-3 of these cashback sites, and get in the habit of checking on cashback deals before you make a purchase. You will get cashback either as cash, or a voucher to spend.

14. Use Honey Extension

Honey is a recent find for us and it works like a charm!

This handy tool can help you find vouchers available for things you buy online.

Honey is a browser extension you can install. Every time you shop online Honey checks to see if there is a voucher or ‘Honey Gold’ that can be applied to your purchase, often saving 10 to 30%.

Honey Gold is a loyalty program where you earn points on the purchase which you can then redeem for Amazon vouchers.

15. Buy Insurance Online

These days you can purchase anything online, which includes buying your house and car insurance.

Finding the best deal online will save you money compared to paying a broker or buying them over the phone.

15. Pay Annually to Save

Many insurance companies offer a price reduction if you pay annually instead of monthly.

So if you are able to pay for the full amount for the year, you will be able to save £5-£10 each month, which translate to over £100 savings a year.

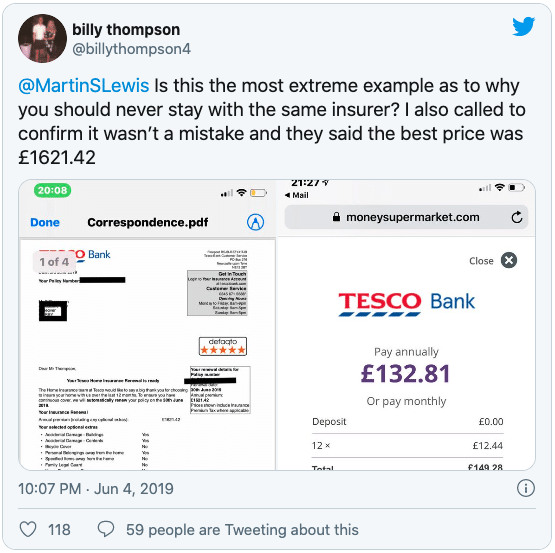

16. Never Let a Contract Auto-Renew

If this is news to you, here’s another golden tip for you, my friend!

Often when a contract renews itself, the premium often increases 10-30%. In certain cases, it goes up to as much as 1000% (see example below).

This applies to car and house insurance, mobile contracts, utility bills etc.

When we previously switched contracts, we were able to save a total of £848 a year, which breaks down to:

- £448 – energy provider

- £250 – house insurance

- £150 – car insurance

So never let your contract auto-renew. Instead, set an alarm 30 days before your contract expires.

This will give you time to shop around for the best deal.

According to Confused.com, the best time to shop for the best deals on your insurance is 21-30 days before your policy expires.

2022 Update: Up until the end of 2021 switching energy tariffs or suppliers was a great way to save money. As energy prices rose and continued to rise in 2022 there are fewer deals and now we are in a position of trying to avoid price hikes – therefore switching may no longer be the best deal. Make sure you do your research on one of the comparison sites.

18. Switch to Energy Saving Light Bulbs

Lighting accounts for 18% of a household utility bill. Switching from regular bulbs to energy-efficient bulbs can save you at least £100 a year.

These modern energy-saving bulbs not only use less energy but also have a longer life than regular bulbs. So all-in-all, one of the simple but effective ways to save money in UK household.

19. Turning Down and Switching off the Heating

Another spend less on the utility bill is to by turning down the heat in your household.

According to Energy Saving Trust, you can save approx. £75 just by turning down your heating by 1 deg C.

So next time, when you feel cold in the house, instead of cranking up the heating, put an extra layer of clothes on.

You can also switch off the heating in the rooms that are unused. This simple change can easily boost your saving to £100 a year.

20. Shower with a Water-Efficient Shower Head

Do you know you can save on your utility bill by simply swapping your normal showerhead with a water-efficient one?

They basically use less water, so you don’t use all your hot water in the shower, and have to use the gas to heat more water back up.

If you have a shower that takes hot water directly from the boiler-heated tank, fitting a water-efficient showerhead can save you as much as £195/year on gas for heating the water and water bill.

This doesn’t work for electric showers.

21. Purchased Second-Hand Items for Your Children

If you are a new parent or have small children, there are certain items for children that you should not spend money on, well, buying brand new at least (take advice from a mum, who brought up 2 children).

They grow so fast, these items simply are not worth the money buying new for the amount of time they use.

Things to consider buying 2nd hand are baby cots, toys, occasional clothes, shoes, bikes etc.

We recently sold the bikes we bought for our girls, 2nd hand, for the same amount as we paid.

22. Sell Things That You Don’t Need

Sell things that you no longer need in your household.

This applies to many baby/children items that are collecting dust in your loft or garage.

Large items that are expensive to ship, are the best for selling locally through FaceBook (Meta) – Market Place.

On the other hand, smaller and higher price tag items are better selling on eBay as you can get more interest and sell quicker.

ENTERTAINMENT

Finally, we are going to explore some household tips on entertainment-related expenses.

Just by applying 2-3 tips below, you can potentially save over another £1,000 a year.

23. Book in Advance

If you want to save money for a large family, make friends with planning and booking ahead. This applies to holidays, events, flights, trains, etc.

Booking holidays, flights a year in advance will not only ensure you the most options but also the lowest price.

You will also save cash on purchasing tickets for events, day trips, train tickets online in advance instead of buying it at the door.

So being a bit organized and booking things ahead will help with money saving challenges.

24. Pack a Lunch on a Family Day Out

A family day out can easily cost up to £100 with entrance fees, food and parking etc. To keep the expense to a minimum, pack your own picnic lunch instead of eating out.

By packing a few sandwiches, snacks and drinks, you can easily dodge a £50 bill for a family of 4.

It will almost certainly be more healthy, and a picnic can be the perfect mid-theme park rest.

25. Saving on BroadBand and TV

Are you spending way too much time and money on your TV packages?

Not sure, well getting a better deal could be a big way of saving money.

Even combining high-speed internet (£30/month) and a Netflix subscription (£9/month), will save you around £60 a month compared to some of the current packages from Sky and Virgin. . Cancel Unused Subscriptions

This is a great way of saving money that often goes unnoticed.

26. Review All Your Subscriptions

These days companies like to sell subscriptions instead of a one-time purchase, why? This will guarantee a regular cash flow for them. Think about Spotify, Audible, Amazon prime, etc.

However, as a consumer, while some of these may be essential to your household, many of you are just paying for convenience.

So review your subscriptions on a regular basis.

Take a look through your bank statement and see if you have any subscriptions that you are not using, cancel them. This can include unused gym memberships, Netflix, magazine subscriptions etc.

Get your FREE Budget Planner Printable to take control of your finances today! ?

Final Thoughts on 25 Smart Household Money Saving Tips UK…

So there you have it, my 25+ tried and tested tips for making your money go further. Simple changes can add up quickly and save big in the future.

Applying a few of these can easily save you over £3,500 a year. Whether it’s packing your own lunch on a family day out or unsubscribing to services you no longer need, every little bit helps!

What would you do with an extra £3,500? I’d love to hear from you…

Related Household Money Saving Tips for UK Families:

25 Smart Household Money Saving Tips UK [Pin it for later]

![Read more about the article 37 Things to Buy From Aldi UK to Save on Food Bill [and Better than Big Brands]](https://itsnotyour9to5.com/wp-content/uploads/2020/05/Things-to-buy-from-Aldi-FB-300x157.png)

![Read more about the article 9 Ways to Cut Your Grocery Bill [While Eating Healthy]](https://itsnotyour9to5.com/wp-content/uploads/2020/05/ways_to_cut_grocery_bill_while_eating_healthy__fb_1-300x157.png)

Hi Chloe,

I really need these tips, specially in these days we’re living, with the economic effects the pandemic has been causing.

Thank you very much for this suggestion of Shopping at Aldi. I’ll be careful of always taking £1 for the shopping trolley. The annual savings of £360 makes Aldi worth a try.

Hi Paolo, glad that you found these helpful. Thanks for stopping by.